ABA numbers, or American Bankers Association routing numbers, are nine-digit codes that play a pivotal role in the financial ecosystem of the United States. These numbers act as identifiers for financial institutions, ensuring seamless transactions between banks. Whether you're setting up direct deposits, sending wire transfers, or writing checks, understanding what are ABA numbers and their function is essential for managing your finances effectively. In this article, we will delve into the intricacies of ABA numbers, exploring their purpose, structure, and significance in banking operations.

As banking becomes increasingly digital, the role of ABA numbers has expanded beyond traditional checks. They now serve as foundational elements in electronic funds transfers, ensuring that money moves securely and efficiently between accounts. This article is designed to provide clarity on the subject, answering common questions and offering actionable insights for anyone who interacts with banking services. Whether you're a small business owner, a student, or a seasoned professional, understanding ABA numbers can help streamline your financial processes.

By the end of this guide, you'll have a comprehensive understanding of what ABA numbers are, how they work, and how to use them effectively in your day-to-day transactions. Let's dive into the details and uncover the importance of these critical banking identifiers.

Read also:Why Pittman And Davis Gift Baskets Stand Out In The Gifting World

What Are ABA Numbers and Why Do They Matter?

ABA numbers are unique nine-digit codes assigned to financial institutions in the United States. They serve as a form of identification, ensuring that banks can communicate with each other efficiently. These numbers are crucial for various banking activities, including check processing, direct deposits, and wire transfers. Without ABA numbers, the banking system would face significant challenges in routing transactions accurately.

The history of ABA numbers dates back to 1910 when the American Bankers Association introduced them to standardize banking operations. Today, these numbers are an integral part of the U.S. financial infrastructure, ensuring that transactions are processed correctly and efficiently. Each ABA number is unique to a specific bank or branch, allowing for precise identification and routing of funds.

How Do You Find Your Bank's ABA Number?

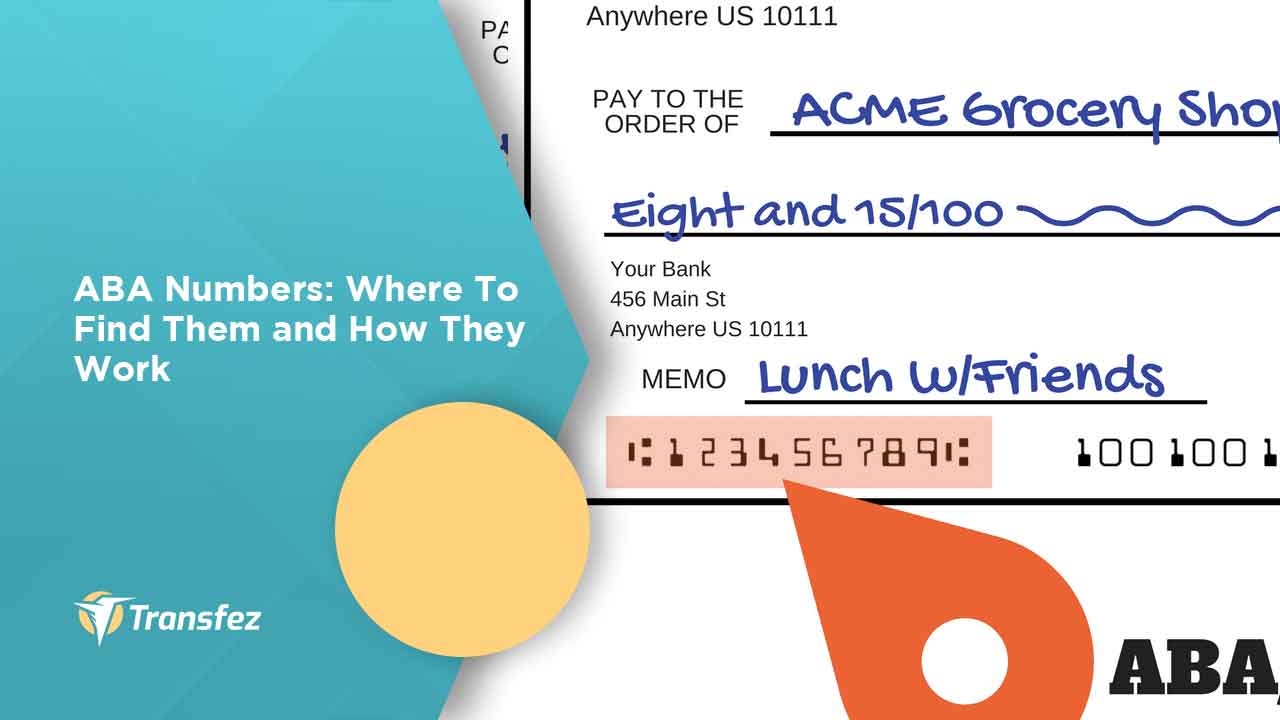

Locating your bank's ABA number is straightforward. You can find it on the bottom left-hand corner of your checks, where it is printed as a series of nine digits. Additionally, most banks provide this information on their official websites or through their customer service departments. If you're unsure about how to locate your ABA number, contacting your bank directly is always a reliable option.

It's important to note that some banks may have multiple ABA numbers depending on the type of transaction. For instance, the ABA number for wire transfers might differ from the one used for direct deposits. Always confirm the correct number with your bank to avoid any potential issues during transactions.

What Are ABA Numbers Used For?

ABA numbers are primarily used for routing financial transactions between banks. They ensure that funds are transferred accurately and securely, whether you're depositing a check, setting up a direct deposit, or initiating a wire transfer. Here are some common uses of ABA numbers:

- Check processing: ABA numbers help banks identify the institution responsible for honoring a check.

- Direct deposits: Employers use ABA numbers to deposit salaries directly into employees' accounts.

- Wire transfers: These numbers facilitate the movement of large sums of money between accounts.

- Automated Clearing House (ACH) transactions: ABA numbers are essential for electronic payments and transfers.

How Are ABA Numbers Structured?

The structure of an ABA number is carefully designed to provide essential information about the bank and its location. The first four digits represent the Federal Reserve Routing Symbol, indicating the Federal Reserve Bank servicing the institution. The next four digits identify the bank itself, while the final digit serves as a checksum to ensure the number's validity.

Read also:Unveiling The Backbone Of Wellness Indian Health Service In Focus

Can ABA Numbers Be Used Internationally?

While ABA numbers are primarily used within the United States, they can be utilized in international transactions involving U.S. banks. However, for cross-border transactions, other identifiers such as SWIFT codes are often required. It's crucial to understand the specific requirements of your bank when engaging in international financial activities.

What Are ABA Numbers and Their Role in Security?

ABA numbers play a significant role in enhancing the security of banking transactions. By providing a standardized method of identifying financial institutions, they reduce the risk of errors and fraud. Banks and financial regulators continuously monitor ABA numbers to detect and prevent unauthorized activities, ensuring the integrity of the financial system.

Common Questions About ABA Numbers

Why Do Some Banks Have Multiple ABA Numbers?

Some banks may have multiple ABA numbers to accommodate different types of transactions. For example, one ABA number might be used for domestic transfers, while another is designated for international transactions. This segmentation allows banks to manage their operations more efficiently and securely.

Is It Safe to Share My ABA Number?

Sharing your ABA number is generally safe, as it only identifies the bank and not your personal account information. However, it's always wise to exercise caution and only provide this information to trusted parties, such as your employer for direct deposits or financial institutions for transfers.

Conclusion: The Importance of Understanding What Are ABA Numbers

In conclusion, ABA numbers are indispensable in the U.S. banking system, ensuring the smooth flow of financial transactions. By understanding what are ABA numbers and their functions, you can better manage your finances and avoid potential pitfalls. Whether you're setting up a direct deposit or initiating a wire transfer, knowing your ABA number is key to successful banking operations.

Final Thoughts on What Are ABA Numbers

As the financial landscape continues to evolve, the role of ABA numbers remains as vital as ever. They provide the backbone for secure and efficient transactions, enabling individuals and businesses to conduct their financial affairs with confidence. By staying informed about ABA numbers and their uses, you can navigate the complexities of modern banking with ease.

How Can You Stay Updated on ABA Numbers?

To stay informed about ABA numbers and related banking regulations, regularly check updates from your bank and relevant financial authorities. Subscribing to financial newsletters and following trusted industry experts can also provide valuable insights into the latest developments in the banking sector.

Table of Contents

- What Are ABA Numbers and Why Do They Matter?

- How Do You Find Your Bank's ABA Number?

- What Are ABA Numbers Used For?

- How Are ABA Numbers Structured?

- Can ABA Numbers Be Used Internationally?

- What Are ABA Numbers and Their Role in Security?

- Common Questions About ABA Numbers

- Why Do Some Banks Have Multiple ABA Numbers?

- Is It Safe to Share My ABA Number?

- Conclusion: The Importance of Understanding What Are ABA Numbers