ABA Routing, a fundamental aspect of banking operations, plays a critical role in ensuring seamless financial transactions across the United States. This unique nine-digit code, assigned to each financial institution, acts as a digital address, enabling the accurate processing of checks, automated clearing house (ACH) transactions, and wire transfers. Understanding the intricacies of ABA Routing is essential for businesses and individuals alike, as it directly impacts the efficiency and security of financial dealings. Whether you're a small business owner managing payroll or an individual setting up direct deposits, this article will equip you with the knowledge to navigate the world of ABA Routing effectively.

As financial systems continue to evolve, the importance of ABA Routing has only grown. It serves as the backbone of the U.S. banking system, ensuring that billions of dollars are routed correctly each day. This article delves into the history, functionality, and practical applications of ABA Routing, offering insights that will empower you to make informed decisions about your financial transactions. By exploring the nuances of this system, you'll gain a deeper appreciation for the infrastructure that underpins modern banking.

In today's digital age, where speed and accuracy are paramount, understanding ABA Routing can help you avoid costly errors and delays. From deciphering the code structure to troubleshooting common issues, this guide will walk you through everything you need to know. Whether you're new to the concept or seeking to deepen your existing knowledge, this article is designed to provide clarity and confidence in navigating the complexities of ABA Routing. Let's explore this vital component of banking together.

Read also:Experience The Vibrant Charm Of Branson Landing Hilton Promenade

What Exactly is ABA Routing?

ABA Routing, officially known as the American Bankers Association Routing Number, is a nine-digit code that identifies financial institutions in the United States. This system was introduced in 1910 to facilitate the sorting and distribution of paper checks. Over time, it has expanded to include electronic transactions, making it an indispensable part of the modern banking infrastructure. Each digit in the ABA Routing number carries specific information, such as the Federal Reserve Bank district and the institution's location.

How Does ABA Routing Work?

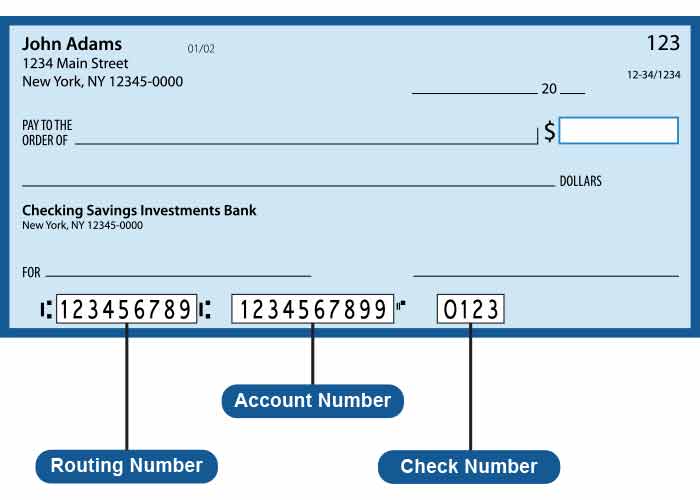

The mechanics of ABA Routing are both fascinating and functional. When you initiate a transaction, the ABA Routing number directs the payment to the correct financial institution. This process involves a series of checks and validations to ensure accuracy and security. For instance, the first two digits of the ABA Routing number indicate the Federal Reserve Bank responsible for processing the transaction. The next four digits identify the specific bank or credit union, while the last digit serves as a check digit to verify the integrity of the code.

Why is ABA Routing Important?

ABA Routing is crucial because it eliminates ambiguity in financial transactions. Without it, the banking system would face significant challenges in processing payments efficiently. For businesses, having the correct ABA Routing number ensures timely payroll deposits and seamless vendor payments. For individuals, it guarantees that direct deposits and bill payments reach their intended accounts without errors. Understanding its importance can help you avoid common pitfalls, such as entering the wrong code or using outdated information.

Where Can You Find Your ABA Routing Number?

Locating your ABA Routing number is straightforward. It is typically printed at the bottom of your checks, appearing as the first set of numbers on the left. Additionally, most banks provide this information on their websites or through their mobile apps. If you're setting up a new account or initiating a transaction, double-checking the ABA Routing number can save you from potential headaches down the line.

What Happens If You Use the Wrong ABA Routing Number?

Mistakes happen, but using the wrong ABA Routing number can lead to significant consequences. Transactions may be delayed, returned, or even sent to the wrong institution. This not only affects your financial plans but can also result in fees or penalties. To prevent such issues, always verify the ABA Routing number before initiating any transaction. If you're unsure, contacting your bank's customer service is a reliable way to confirm the correct code.

How Can You Verify an ABA Routing Number?

Verifying an ABA Routing number is easier than you might think. Many banks offer online tools or mobile app features that allow you to confirm the code's validity. Additionally, websites dedicated to financial services often provide lookup tools for this purpose. By taking a few extra moments to verify the ABA Routing number, you can ensure that your transactions proceed without a hitch.

Read also:Comprehensive Guide To Dish Tv Support Phone Number For Seamless Service

Can ABA Routing Numbers Change?

Yes, ABA Routing numbers can change, though such occurrences are relatively rare. Mergers, acquisitions, or changes in banking regulations may necessitate updates to these codes. If your bank undergoes such changes, they will typically notify you in advance. Keeping track of these updates is essential to maintaining the accuracy of your financial records. Staying informed about potential changes to your ABA Routing number can save you from unnecessary complications.

What Are the Different Types of ABA Routing Numbers?

Not all ABA Routing numbers are created equal. Some are designated for wire transfers, while others are used for ACH transactions. Understanding the differences can help you choose the appropriate code for your specific needs. For example, wire transfers often require a different ABA Routing number than those used for direct deposits. Consulting your bank's guidelines can clarify which code to use for each type of transaction.

Is ABA Routing Secure?

The security of ABA Routing numbers is a top priority for financial institutions. Advanced encryption and verification processes ensure that these codes are protected from unauthorized access. However, it's essential to safeguard your ABA Routing number as you would any other sensitive financial information. Avoid sharing it unnecessarily and regularly monitor your accounts for any suspicious activity.

How Has ABA Routing Evolved Over Time?

The evolution of ABA Routing reflects the broader advancements in the financial industry. From its origins as a manual check-sorting system to its current role in digital transactions, this code has adapted to meet the demands of an ever-changing world. As technology continues to progress, ABA Routing will undoubtedly evolve further, incorporating new features and capabilities to enhance its functionality.

What Should You Know About International Transactions and ABA Routing?

While ABA Routing numbers are primarily used within the United States, they can also play a role in international transactions. For instance, when foreign entities send payments to U.S. banks, they often require the ABA Routing number to ensure proper routing. Understanding the nuances of international transactions and ABA Routing can help you navigate cross-border payments with confidence.

What Are Some Common Misconceptions About ABA Routing?

Despite its widespread use, several misconceptions surround ABA Routing. One common myth is that all banks share the same ABA Routing number, which is incorrect. Each financial institution has its unique code, tailored to its specific needs. Another misconception is that ABA Routing numbers are interchangeable for all types of transactions, which can lead to errors. By dispelling these myths, you can approach your financial dealings with greater clarity and precision.

What Are the Benefits of Understanding ABA Routing?

Gaining a thorough understanding of ABA Routing offers numerous benefits. It empowers you to manage your finances more effectively, avoid costly mistakes, and optimize your banking experience. Whether you're a business owner or an individual, knowing how ABA Routing works can enhance your financial literacy and confidence. Additionally, staying informed about this system can help you adapt to future changes in the banking landscape.

What Steps Can You Take to Protect Your ABA Routing Number?

Protecting your ABA Routing number is crucial for maintaining the security of your financial accounts. Implementing strong passwords, enabling two-factor authentication, and monitoring your transactions regularly are just a few steps you can take. By prioritizing the security of your ABA Routing number, you can safeguard your financial well-being and peace of mind.

What Resources Are Available to Learn More About ABA Routing?

For those eager to deepen their knowledge of ABA Routing, a wealth of resources is available. Financial institutions, industry publications, and online forums offer valuable insights into this topic. Additionally, attending workshops or webinars focused on banking and finance can provide hands-on learning opportunities. By exploring these resources, you can expand your understanding of ABA Routing and its role in the financial ecosystem.

Conclusion: Embrace the Power of ABA Routing

ABA Routing is more than just a series of numbers; it's a cornerstone of modern banking. By understanding its functionality, importance, and applications, you can take control of your financial transactions and ensure they proceed smoothly. Whether you're setting up direct deposits, initiating wire transfers, or managing payroll, ABA Routing plays a vital role in your financial journey. Embrace this knowledge and empower yourself to navigate the complexities of banking with confidence.

In conclusion, ABA Routing is a vital component of the financial infrastructure that supports millions of transactions daily. By staying informed and vigilant, you can harness its power to enhance your financial management and security. As the banking industry continues to evolve, so too will ABA Routing, offering new opportunities and challenges for all who use it.

Table of Contents

- What Exactly is ABA Routing?

- How Does ABA Routing Work?

- Why is ABA Routing Important?

- Where Can You Find Your ABA Routing Number?

- What Happens If You Use the Wrong ABA Routing Number?

- How Can You Verify an ABA Routing Number?

- Can ABA Routing Numbers Change?

- What Are the Different Types of ABA Routing Numbers?

- Is ABA Routing Secure?

- How Has ABA Routing Evolved Over Time?