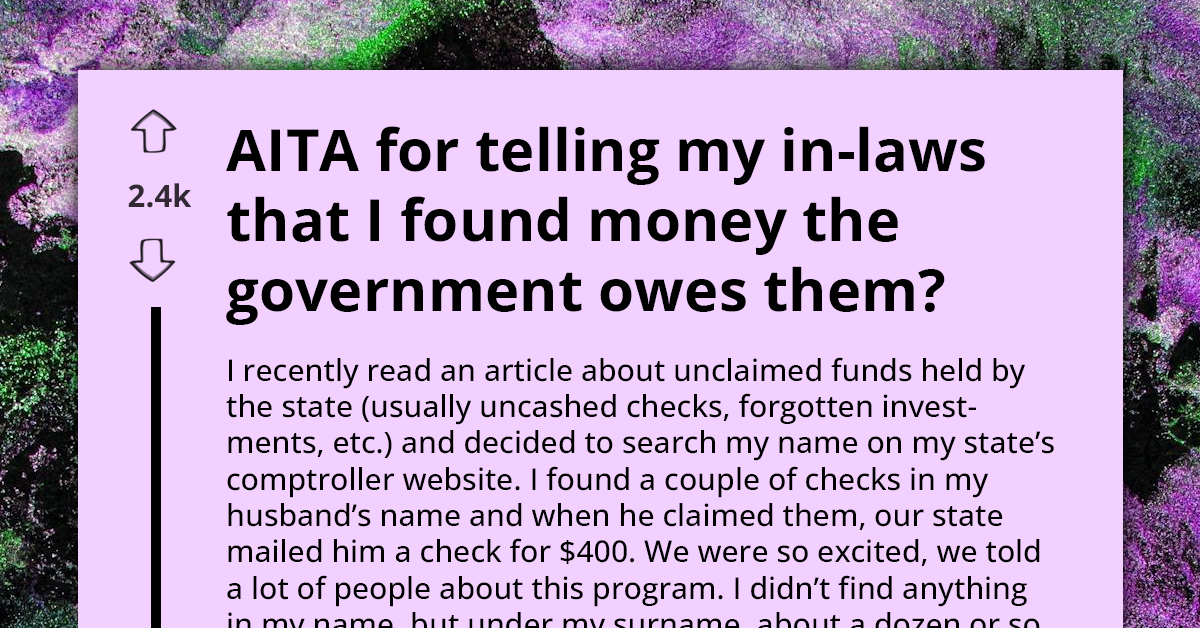

Are you aware that Pennsylvania holds millions of dollars in unclaimed money waiting to be claimed by rightful owners? Every year, countless individuals miss out on retrieving funds simply because they don’t know where to start. From forgotten bank accounts to uncashed checks, the state of Pennsylvania has established a robust system to help residents recover their lost money. This article dives deep into the world of PA unclaimed money, offering actionable insights and step-by-step guidance to ensure you don’t leave your financial assets behind.

Discovering PA unclaimed money is not just about reclaiming forgotten funds—it’s about taking control of your financial future. Whether it’s a small refund or a substantial inheritance, understanding the process and leveraging the right resources can make all the difference. In this article, we’ll explore everything from how unclaimed funds are created to the tools and platforms available to track them down. Our goal is to empower you with the knowledge and confidence to navigate this often-overlooked aspect of personal finance.

With millions of dollars sitting idle in Pennsylvania’s unclaimed property database, it’s crucial to stay informed and proactive. By the end of this guide, you’ll have a clear understanding of what constitutes PA unclaimed money, how to search for it, and the steps required to claim your rightful assets. Let’s embark on this journey together and uncover the hidden opportunities waiting for you.

Read also:Why Hilton Garden Inn Ridgefield Park Nj Stands Out Among Travelers

What Is PA Unclaimed Money?

PA unclaimed money refers to financial assets that have been inactive or abandoned by their rightful owners for a specified period. These assets may include bank accounts, insurance payments, utility deposits, and even dividends. When businesses or institutions cannot locate the owners of these funds, they are required by law to report them to the state, which then holds the money until it is claimed. This process ensures that no funds are permanently lost and provides individuals with a chance to recover what is rightfully theirs.

How Does PA Unclaimed Money Accumulate?

Unclaimed funds accumulate due to various reasons, such as moving without updating contact information, forgetting about old accounts, or failing to cash checks in time. Over time, these small oversights can lead to significant amounts of money being held by the state. Pennsylvania’s unclaimed property office meticulously tracks these funds and provides resources for residents to search and reclaim them. Understanding the common causes of unclaimed money can help you avoid losing track of your assets in the future.

Why Should You Care About PA Unclaimed Money?

Reclaiming PA unclaimed money offers more than just financial benefits; it’s an opportunity to reconnect with forgotten assets and improve your financial well-being. Whether you’re planning for retirement, paying off debt, or investing in your future, every dollar counts. Moreover, the process of searching for unclaimed funds can serve as a valuable reminder to regularly review and organize your financial records, ensuring you stay on top of your financial health.

How Can I Find My PA Unclaimed Money?

Locating PA unclaimed money has never been easier, thanks to advancements in technology and the state’s commitment to transparency. Pennsylvania provides multiple avenues for residents to search for and claim their funds. Below, we outline the key steps to guide you through the process:

- Visit the official Pennsylvania Treasury website, which offers a user-friendly search tool.

- Utilize national databases like MissingMoney.com, which aggregates unclaimed property records from across the United States.

- Check with financial institutions, employers, and utility companies for any outstanding balances in your name.

Do I Need to Pay Fees to Claim My PA Unclaimed Money?

One common misconception about claiming PA unclaimed money is that it requires fees or the assistance of third-party services. In most cases, the state allows individuals to claim their funds directly and free of charge. However, if you choose to work with a recovery service, it’s essential to verify their legitimacy and understand any associated costs. Always prioritize using official state resources to avoid unnecessary expenses and potential scams.

Can Someone Else Claim My PA Unclaimed Money?

Rest assured that PA unclaimed money is protected by strict regulations to prevent unauthorized claims. To claim funds, individuals must provide proof of identity and ownership, ensuring that only the rightful owner can access the money. If you suspect someone is attempting to claim your assets fraudulently, report the incident to the Pennsylvania Treasury immediately. Staying vigilant and safeguarding your personal information is key to protecting your unclaimed money.

Read also:Exploring The Life And Marriage Of Liz Cheney Who Is She Married To

What Happens If You Don’t Claim PA Unclaimed Money?

If you fail to claim PA unclaimed money, the funds will remain in the state’s custody indefinitely. While the state does not relinquish ownership of these assets, the longer you wait, the harder it may become to locate and claim them. Additionally, inflation and changing regulations could impact the value of your funds over time. Taking action sooner rather than later ensures you maximize the benefits of reclaiming your unclaimed money.

What Are the Most Common Types of PA Unclaimed Money?

PA unclaimed money encompasses a wide range of financial assets, each with its own set of rules and requirements. Some of the most common types include:

- Bank accounts and savings

- Stocks, bonds, and dividends

- Insurance payouts and refunds

- Payroll checks and employee benefits

- Utility deposits and security deposits

Understanding the different categories of unclaimed funds can help you narrow down your search and increase your chances of finding forgotten assets.

How Long Does It Take to Claim PA Unclaimed Money?

The timeline for claiming PA unclaimed money varies depending on the type of asset and the complexity of the claim. Simple cases, such as recovering a forgotten bank account, can be resolved within weeks. However, more intricate situations, like inheritance claims, may take several months to process. Regardless of the duration, patience and persistence are key to successfully reclaiming your funds.

Is There a Deadline for Claiming PA Unclaimed Money?

Fortunately, Pennsylvania does not impose a deadline for claiming unclaimed money. This means that even if years have passed since the funds were reported as inactive, you still have the right to reclaim them. However, acting promptly is always advisable to avoid complications and ensure the smooth recovery of your assets.

Table of Contents

- What Is PA Unclaimed Money?

- How Does PA Unclaimed Money Accumulate?

- Why Should You Care About PA Unclaimed Money?

- How Can I Find My PA Unclaimed Money?

- Do I Need to Pay Fees to Claim My PA Unclaimed Money?

- Can Someone Else Claim My PA Unclaimed Money?

- What Happens If You Don’t Claim PA Unclaimed Money?

- What Are the Most Common Types of PA Unclaimed Money?

- How Long Does It Take to Claim PA Unclaimed Money?

- Is There a Deadline for Claiming PA Unclaimed Money?

In conclusion, PA unclaimed money represents a valuable opportunity for residents to recover lost assets and enhance their financial stability. By following the steps outlined in this guide and utilizing the resources provided by the state, you can take control of your financial future. Remember, the journey to reclaiming your unclaimed money begins with awareness and action. Start your search today and unlock the potential of your forgotten funds.