When it comes to banking and financial transactions, understanding the ABA bank routing number is crucial for ensuring seamless money transfers and checks processing. The ABA routing number, also known as the routing transit number (RTN), acts as a unique identifier for financial institutions in the United States. It ensures that your money is routed to the correct bank or credit union. Whether you're setting up direct deposits, paying bills online, or transferring funds between accounts, knowing your bank's ABA routing number is essential.

As financial systems evolve, the role of the ABA routing number becomes even more critical. This nine-digit code was first introduced by the American Bankers Association (ABA) in 1910, and it has since become a cornerstone of the U.S. banking system. Its primary function is to streamline the processing of checks and electronic payments. With the rise of digital banking, the importance of this number has only grown, making it vital for both personal and business banking needs.

For those unfamiliar with the concept, the ABA bank routing number can sometimes seem confusing. However, once you understand its structure and purpose, it becomes much easier to navigate. This guide will break down everything you need to know about ABA routing numbers, including how to find yours, common uses, and potential issues to watch out for. Whether you're a seasoned banker or a newcomer to the world of finance, this information will prove invaluable.

Read also:Unveiling The Magic Of Hulen Cinema Your Ultimate Entertainment Destination

What is an ABA Bank Routing Number?

An ABA bank routing number is a nine-digit code assigned to financial institutions in the United States. This number helps identify the specific bank or credit union involved in a transaction. Each digit in the ABA routing number carries significance, with the first two digits indicating the Federal Reserve Bank responsible for overseeing the institution. The remaining digits provide further details about the bank's location and type.

Why is the ABA Routing Number Important?

The ABA routing number plays a pivotal role in the banking system by ensuring accurate and efficient processing of transactions. Without it, banks would face significant challenges in verifying the authenticity of checks and electronic payments. Moreover, the ABA routing number helps prevent fraud by providing an additional layer of security during financial transactions. For businesses, having the correct ABA routing number is crucial for payroll processing and vendor payments.

How Do You Find Your ABA Bank Routing Number?

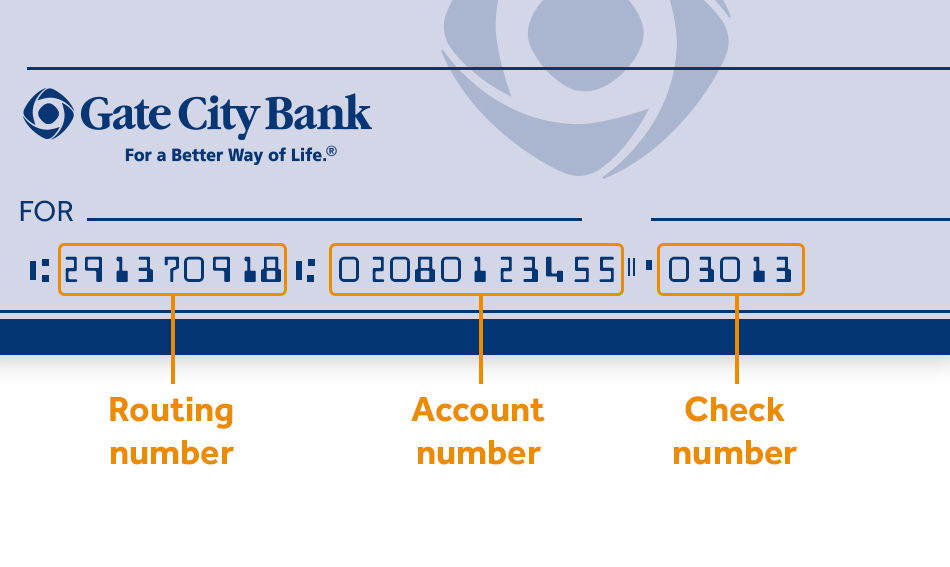

Finding your ABA bank routing number is relatively straightforward. It is usually located at the bottom left corner of your personal checks, next to your account number. Alternatively, you can check your bank's website or contact customer service for assistance. Some banks also provide this information through their mobile apps, making it even more accessible for tech-savvy users. Remember, the ABA routing number may differ for wire transfers, so always confirm with your bank if you're unsure.

What Should You Know About the Structure of an ABA Routing Number?

The structure of an ABA routing number is carefully designed to convey essential information about the financial institution. The first four digits represent the Federal Reserve Routing Symbol, which identifies the Federal Reserve Bank that processes transactions for the institution. The next four digits are the ABA Institution Identifier, indicating the specific bank or credit union. Finally, the last digit serves as a checksum to verify the validity of the entire number.

What is the Difference Between ABA and ACH Routing Numbers?

While ABA routing numbers are primarily used for check processing, ACH routing numbers are designed for electronic transactions such as direct deposits and bill payments. Although these numbers are often the same, some banks may use different codes for ACH transactions. It's essential to verify which number to use based on the type of transaction you're conducting. This distinction is particularly important for businesses that rely heavily on electronic payments.

What Happens if You Use the Wrong ABA Bank Routing Number?

Using the wrong ABA bank routing number can lead to significant complications, including delayed or failed transactions. In some cases, the bank may reject the transaction altogether, requiring you to resubmit it with the correct information. To avoid these issues, always double-check the routing number before initiating any financial transaction. If you're unsure about your bank's routing number, consult your bank statement or contact customer service for clarification.

Read also:Michigan State University Football A Legacy Of National Championships

How Secure is the ABA Bank Routing Number?

Despite its importance, the ABA routing number is not inherently secure. While it doesn't provide direct access to your account, it can be used in conjunction with other information to commit fraud. For this reason, it's crucial to keep your routing number confidential and only share it with trusted parties. Many banks offer additional security measures, such as multi-factor authentication, to protect your financial information.

What Should You Do if You Suspect Fraud Involving Your ABA Routing Number?

If you suspect fraudulent activity involving your ABA routing number, it's essential to act quickly. Contact your bank immediately to report the issue and request a new routing number if necessary. Monitor your account statements regularly for any unauthorized transactions and notify your bank if you notice anything suspicious. By staying vigilant, you can help protect your financial information and prevent potential losses.

What is the Role of the ABA Bank Routing Number in International Transactions?

While ABA routing numbers are primarily used for domestic transactions within the United States, they can also play a role in international transactions. For example, when sending money to a U.S. bank from abroad, the sender may need to provide the recipient's ABA routing number to ensure the funds are routed correctly. However, for outgoing international transfers, a SWIFT code is typically required instead of an ABA routing number.

Key Points to Remember About ABA Bank Routing Numbers

- ABA routing numbers are nine-digit codes that identify financial institutions in the U.S.

- They are essential for processing checks and electronic payments.

- Always verify the correct routing number for the type of transaction you're conducting.

- Keep your routing number confidential to protect against fraud.

What is the Future of ABA Bank Routing Numbers in Banking?

As banking technology continues to evolve, the role of ABA routing numbers may change. While they remain a vital component of the current banking system, advancements in digital banking could lead to new methods of identifying financial institutions. For now, however, ABA routing numbers remain a reliable and necessary tool for ensuring accurate and secure financial transactions. Staying informed about these developments will help you navigate the ever-changing landscape of modern banking.

What Resources Are Available for Learning More About ABA Bank Routing Numbers?

If you'd like to learn more about ABA bank routing numbers, several resources are available. The American Bankers Association provides detailed information about the history and function of routing numbers. Additionally, many banks offer educational materials and customer support to help you understand how to use your routing number effectively. By taking advantage of these resources, you can gain a deeper understanding of this critical aspect of banking.

Table of Contents

- What is an ABA Bank Routing Number?

- Why is the ABA Routing Number Important?

- How Do You Find Your ABA Bank Routing Number?

- What Should You Know About the Structure of an ABA Routing Number?

- What is the Difference Between ABA and ACH Routing Numbers?

- What Happens if You Use the Wrong ABA Bank Routing Number?

- How Secure is the ABA Bank Routing Number?

- What Should You Do if You Suspect Fraud Involving Your ABA Routing Number?

- What is the Role of the ABA Bank Routing Number in International Transactions?

- Key Points to Remember About ABA Bank Routing Numbers

In conclusion, understanding the ABA bank routing number is essential for anyone involved in banking or financial transactions. By familiarizing yourself with its structure, purpose, and potential risks, you can ensure smoother and more secure financial dealings. Whether you're managing personal finances or overseeing business operations, knowing your ABA routing number is a crucial step in maintaining financial health. As the banking industry continues to evolve, staying informed about these developments will help you make the most of your banking experience.