ABA Routing Codes play a pivotal role in the financial ecosystem by ensuring seamless transactions between banks. These nine-digit numbers serve as a digital address, directing funds to the correct financial institution. Without ABA Routing Codes, the banking system would face significant delays and inefficiencies. Understanding how these codes work is essential for both individuals and businesses, as they streamline the process of transferring money domestically.

As we dive deeper into the world of ABA Routing Codes, it becomes evident that their importance extends beyond mere identification. They are the backbone of electronic fund transfers, check processing, and direct deposits. This article aims to demystify the intricacies of ABA Routing Codes, offering valuable insights that can empower users to navigate their banking activities with confidence. Whether you're a seasoned financial professional or a beginner exploring banking basics, this guide will provide comprehensive information tailored to your needs.

For those unfamiliar with ABA Routing Codes, this article serves as an excellent starting point. We will explore their history, structure, and practical applications while addressing common questions and concerns. By the end of this article, you'll have a solid understanding of how ABA Routing Codes function and why they are indispensable in today's banking landscape. Let's embark on this journey to uncover the secrets behind these crucial identifiers.

Read also:Rambo Cast Unveiling The Legendary Ensemble That Defined Action Cinema

What is an ABA Routing Code?

An ABA Routing Code, also known as a routing transit number (RTN), is a nine-digit code assigned to financial institutions in the United States. It was originally developed by the American Bankers Association (ABA) in 1910 to facilitate check processing. Over time, its applications have expanded to include electronic fund transfers, direct deposits, and automated clearing house (ACH) transactions. Each ABA Routing Code is unique to a specific bank or credit union, ensuring accurate routing of financial transactions.

How Do ABA Routing Codes Work?

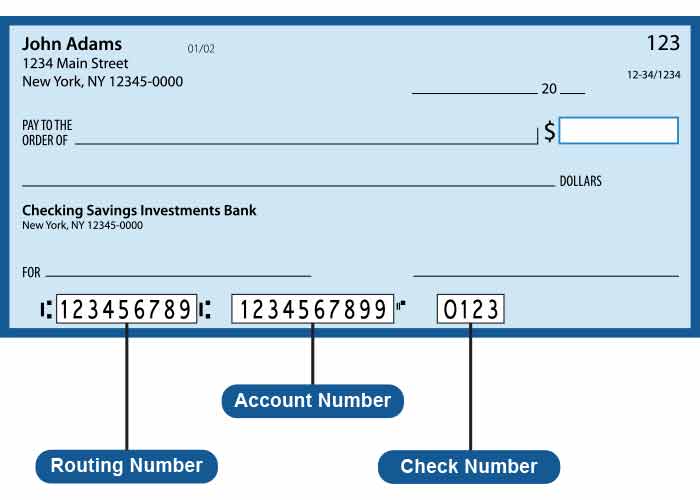

ABA Routing Codes function as a digital address for financial institutions. When you initiate a transaction, such as a direct deposit or wire transfer, the ABA Routing Code ensures that the funds are directed to the correct bank or credit union. The code is divided into three parts: the first four digits represent the Federal Reserve routing symbol, the next four digits identify the bank or credit union, and the final digit serves as a checksum to verify the code's validity.

Why is an ABA Routing Code Important?

ABA Routing Codes are essential for maintaining the integrity and efficiency of the banking system. Without them, financial transactions would be prone to errors and delays. They ensure that funds are routed to the correct institution, preventing discrepancies and enhancing security. Additionally, ABA Routing Codes enable the automation of many banking processes, reducing the need for manual intervention and minimizing the risk of human error.

Where Can You Find Your ABA Routing Code?

Locating your ABA Routing Code is straightforward. You can find it on your checks, online banking portal, or by contacting your bank directly. On a check, the ABA Routing Code is the nine-digit number located at the bottom left corner. It is usually followed by your account number and the check number. If you prefer not to use checks, most banks provide the ABA Routing Code on their websites or through their mobile apps.

Can ABA Routing Codes Be Used Internationally?

ABA Routing Codes are primarily used for domestic transactions within the United States. For international transactions, banks typically use SWIFT codes or IBANs. However, some banks may provide additional routing instructions for cross-border transfers. It's important to verify the specific requirements of your bank when initiating an international transaction to ensure smooth processing.

How to Verify an ABA Routing Code?

Verifying an ABA Routing Code is crucial to avoid transaction errors. You can use online tools provided by your bank or third-party verification services to confirm the validity of the code. Additionally, most banks offer customer support to assist with verification. If you encounter any discrepancies, contact your bank immediately to resolve the issue.

Read also:Rich Homie Quan A Journey From Atlanta To Global Fame

Do All Banks Have an ABA Routing Code?

Yes, all banks and credit unions in the United States have an ABA Routing Code. However, some institutions may have multiple codes depending on their size and geographic reach. For example, large national banks may have different ABA Routing Codes for various regions or branches. It's important to use the correct code for your specific account to ensure accurate processing of transactions.

What Happens If You Use the Wrong ABA Routing Code?

Using the wrong ABA Routing Code can result in transaction delays or rejection. In some cases, the funds may be returned to the sender, requiring them to initiate the transfer again with the correct code. To avoid such issues, always double-check the ABA Routing Code before initiating a transaction. If you're unsure, consult your bank for clarification.

Can ABA Routing Codes Change?

Yes, ABA Routing Codes can change due to mergers, acquisitions, or other organizational changes. If your bank undergoes such a change, they will notify you of any updates to your ABA Routing Code. It's important to keep your records up to date to ensure uninterrupted banking services.

How Do ABA Routing Codes Enhance Banking Security?

ABA Routing Codes contribute to banking security by providing a standardized system for identifying financial institutions. This standardization reduces the risk of fraud and errors, ensuring that transactions are processed accurately and efficiently. Additionally, the checksum feature of ABA Routing Codes adds an extra layer of security by verifying the validity of the code before processing any transaction.

What Are the Different Types of ABA Routing Codes?

There are two main types of ABA Routing Codes: paper and electronic. Paper routing codes are used for check processing, while electronic routing codes are used for ACH transactions and wire transfers. Some banks may have separate codes for these purposes, so it's important to use the appropriate code for each type of transaction.

Conclusion: The Importance of Understanding ABA Routing Codes

In conclusion, ABA Routing Codes are an integral part of the banking system, ensuring the smooth and secure transfer of funds. By understanding their structure and function, you can navigate your financial transactions with confidence and efficiency. Whether you're initiating a direct deposit, wire transfer, or check payment, knowing your ABA Routing Code is essential for success.

Key Takeaways About ABA Routing Codes

- ABA Routing Codes are nine-digit numbers assigned to financial institutions in the U.S.

- They ensure accurate routing of funds during transactions.

- They are used for both paper and electronic transactions.

- Verifying the correct ABA Routing Code is crucial to avoid errors and delays.

Table of Contents

- What is an ABA Routing Code?

- How Do ABA Routing Codes Work?

- Why is an ABA Routing Code Important?

- Where Can You Find Your ABA Routing Code?

- Can ABA Routing Codes Be Used Internationally?

- How to Verify an ABA Routing Code?

- Do All Banks Have an ABA Routing Code?

- What Happens If You Use the Wrong ABA Routing Code?

- Can ABA Routing Codes Change?

- How Do ABA Routing Codes Enhance Banking Security?