Routing ABA numbers play a crucial role in the banking system, ensuring that transactions are processed accurately and efficiently. If you've ever wondered how money moves seamlessly between banks or how direct deposits work, the answer lies in this unique nine-digit code. Often referred to as the "routing transit number," it acts as a digital address that identifies financial institutions. In this article, we'll delve deep into the world of routing ABA numbers, exploring their origins, purpose, and significance in today's digital banking landscape.

For those unfamiliar with banking terminology, the term "routing ABA number" might sound complex. However, its function is straightforward and essential. This number ensures that your money reaches the correct destination, whether you're sending funds, receiving a paycheck, or paying bills online. By understanding what a routing ABA number is and how it works, you can make more informed decisions about your finances and avoid common mistakes.

As we move toward a cashless society, the importance of routing ABA numbers has only grown. They are integral to electronic fund transfers (EFTs), wire transfers, and automated clearing house (ACH) transactions. This guide will provide a comprehensive overview, answering key questions and offering actionable insights for both individual users and businesses. Whether you're setting up a new account or troubleshooting an issue, this article aims to demystify the concept of routing ABA numbers.

Read also:Unlock Your Career Potential A Comprehensive Guide To Autonation Jobs

What Exactly is a Routing ABA Number?

At its core, a routing ABA number is a unique identifier assigned to banks and credit unions in the United States. This nine-digit code was first introduced by the American Bankers Association (ABA) in 1910 to streamline check processing. Over time, its applications have expanded to include electronic transactions, making it an indispensable part of the modern banking infrastructure.

How Does the Routing ABA Number Work?

When you initiate a transaction, the routing ABA number serves as a roadmap for the financial system. It directs the transaction to the appropriate bank or credit union, ensuring that funds are credited or debited from the correct account. Each digit in the code carries specific information, such as the geographic location of the bank and whether the transaction involves checks or electronic transfers.

Why is the Routing ABA Number Important?

Without a routing ABA number, the banking system would face significant challenges in processing transactions efficiently. It ensures that funds are routed to the correct institution, reducing the risk of errors and fraud. Additionally, it facilitates seamless communication between banks, enabling them to execute transactions quickly and securely.

Where Can You Find Your Routing ABA Number?

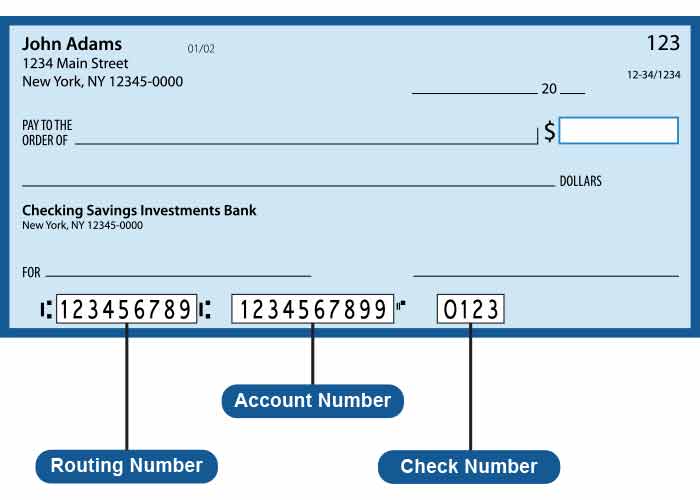

Locating your routing ABA number is straightforward. You can find it on your checks, in your online banking portal, or by contacting your bank directly. Here's how:

- On Checks: The routing ABA number is typically printed at the bottom of your checks, appearing before your account number.

- Online Banking: Most banks provide this information in the account details section of their online platforms.

- Customer Support: If you're unsure, reaching out to your bank's customer service team can provide quick clarification.

What Happens if You Use the Wrong Routing ABA Number?

Using an incorrect routing ABA number can lead to transaction delays, rejection, or even financial loss. For example, if you enter the wrong number while setting up a direct deposit, your paycheck may not reach your account. Similarly, wire transfers could be misdirected, causing unnecessary complications. Therefore, double-checking the number before initiating any transaction is crucial.

How Can You Confirm the Accuracy of Your Routing ABA Number?

To ensure accuracy, cross-reference the number using multiple sources. Compare the routing ABA number on your checks with the one listed in your online banking portal. If discrepancies arise, contact your bank immediately to resolve the issue. Many banks also offer verification tools or resources to help customers confirm their routing ABA numbers.

Read also:Comprehensive Guide To Southboro Medical Group Southboro Your Trusted Healthcare Partner

What is the Difference Between a Routing ABA Number and an Account Number?

While both numbers are essential for banking transactions, they serve different purposes. The routing ABA number identifies the bank, while the account number specifies the individual account within that institution. Think of the routing ABA number as the street address and the account number as the house number. Together, they ensure that funds are directed to the correct destination.

Can a Bank Have Multiple Routing ABA Numbers?

Yes, larger banks often have multiple routing ABA numbers depending on the type of transaction or geographic location. For instance, one routing ABA number might be used for checks, while another is designated for electronic transfers. Understanding these distinctions is vital, especially when dealing with national or international banks.

What Should You Do if Your Bank Changes Its Routing ABA Number?

Bank mergers or acquisitions can sometimes result in changes to routing ABA numbers. In such cases, your bank will typically notify you in advance, providing detailed instructions on how to update your records. It's essential to update any automated payments or direct deposits to reflect the new number promptly.

What is the History Behind the Routing ABA Number?

The concept of routing ABA numbers dates back to the early 20th century when the banking industry sought to standardize check processing. The American Bankers Association introduced the system in 1910 to address the growing need for efficiency and accuracy. Over the decades, advancements in technology have expanded its applications, making it a cornerstone of modern banking operations.

What is Routing ABA Number in Relation to International Transactions?

While routing ABA numbers are primarily used within the United States, they can also play a role in international transactions. For instance, when sending money from a U.S. bank to a foreign account, the routing ABA number helps identify the originating bank. However, additional codes, such as SWIFT or IBAN, are often required for cross-border transfers.

What Are Some Common Misconceptions About Routing ABA Numbers?

One common misconception is that all banks share the same routing ABA number. In reality, each financial institution has its unique identifier. Another misunderstanding is that the routing ABA number alone is sufficient for international transfers, which is not the case. Educating yourself about these nuances can prevent costly errors.

How Can You Protect Your Routing ABA Number?

While routing ABA numbers are generally safe to share, exercising caution is always advisable. Avoid posting this information publicly or sharing it unnecessarily. If you suspect unauthorized use, report it to your bank immediately. Implementing strong security measures, such as two-factor authentication, can further safeguard your financial data.

What is the Future of Routing ABA Numbers in Banking?

As banking technology continues to evolve, the role of routing ABA numbers may shift. Innovations like blockchain and digital currencies could introduce new systems for transaction processing. However, for the foreseeable future, routing ABA numbers remain a fundamental component of the banking infrastructure, ensuring the smooth flow of funds across the financial ecosystem.

What Resources Are Available for Learning More About Routing ABA Numbers?

For those eager to deepen their understanding, numerous resources are available. The American Bankers Association offers detailed guides and FAQs. Additionally, your bank's website or customer service team can provide valuable insights specific to your institution. Staying informed empowers you to manage your finances confidently and effectively.

Conclusion: Embrace the Power of Your Routing ABA Number

In conclusion, the routing ABA number is a vital piece of the banking puzzle, enabling seamless transactions and fostering trust in the financial system. By understanding what it is, how it works, and its significance, you can navigate the complexities of modern banking with ease. Whether you're a seasoned financier or a newcomer to the world of finance, this knowledge equips you to make smarter financial decisions. Remember, the routing ABA number is more than just a sequence of digits—it's the key to unlocking the potential of your financial future.

Table of Contents

- What Exactly is a Routing ABA Number?

- How Does the Routing ABA Number Work?

- Why is the Routing ABA Number Important?

- Where Can You Find Your Routing ABA Number?

- What Happens if You Use the Wrong Routing ABA Number?

- How Can You Confirm the Accuracy of Your Routing ABA Number?

- What is the Difference Between a Routing ABA Number and an Account Number?

- Can a Bank Have Multiple Routing ABA Numbers?

- What Should You Do if Your Bank Changes Its Routing ABA Number?

- What is the History Behind the Routing ABA Number?